Earnio's record results for November 2024

December 12, 2024

Tomáš Hucík

Donald Trump won the presidential election.

I don't know how many times I'll have to write that line at the beginning of any article, but it's important to put the whole message in context. Because it means that cryptocurrencies have the green light in the US. And because the US is still the strongest geopolitical player, and because the dollar is de facto the strongest currency, this US stance is influencing the development of cryptocurrencies around the world.

BITCOIN and ETF inflows

In fact, almost immediately after the election of Donald Trump as president, inflows into spot bitcoin ETFs increased significantly. That's because investors who had been holding off on buying due to uncertain future political development finally know where they stand.

After half a year of smaller flows, capital inflows into ETFs have been bursting since the beginning of November. Source: theblock.com

ETHEREUM and ETF inflows

Interestingly, however, purchases into spot ether ETFs have picked up as well. Some days, the ETH inflows even surpassed BTC inflows.

But don't be scared, I mean relative to its own market capitalization (market cap is calculated as the number of units in circulation times the price of one unit). Still, this is great news for fans of the second biggest cryptocurrency.

Inflows into spot ETFs are also starting to pick up gradually. Source: fairside.com

Ethereum (ETH) price problems

Ethereum has long faced criticism that ether is not as user-friendly as other, newer and faster cryptocurrencies.

The counterargument to this, however, is that these newer cryptocurrencies are not decentralized enough.

A counterargument to this counterargument may be that users are more concerned with user-friendliness than decentralization.

But the counterargument to that last counterargument could be that if people mainly want speed, they can safely use Layer 2 blockchains built on top of Ethereum that are faster but maintain its security.

But the counterargument to that is that Ethereum itself doesn't benefit that much from it monetarily, because the fees that these Layer 2 blockchains send to Ethereum are small since the introduction of blobs (the mechanics of sending data from the Layer 2 blockchain to the parent Ethereum blockchain using sort of batches of transactions all at once), and furthermore, Layer 2 blockchains are draining users and applications away from the underlying Ethereum layer.

So here again we run into the old familiar paradox that Ethereum users and Ethereum investors are two different groups that may have two different goals. Users want to have the most efficient and cheapest network possible, while ETH investors want it to yield as much as possible. However, these two things can sometimes be mutually exclusive and finding a balance between them is not easy.

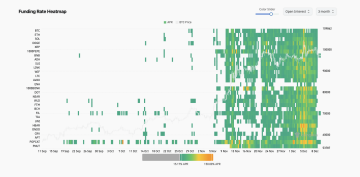

Funding rates in futures trading

One interesting indicator of market development is, for example, the so-called "heat map" of funding rates. It expresses the mechanism of regular payments between short position holders (traders who trade on falling prices) and long position holders (traders who trade on rising prices).

Well, since the election of Donald Trump, funding rate has been more than 15% a year, with few exceptions. That means that if you leveraged futures trading and speculated on the upside, keeping that position open will cost you more than 15% a year on average.

It sounds complicated, but what is the point? Basically, translated, it means that there are many more traders who believe the price will go up than those who think the price will go down. So the longs have to pay the shorts.

In the picture, the days when the funding rates were above 15% are filtered. Source:coinglass.com

Carry trade on BTC

By the way, there is a relatively good deal on offer here. Its essence is that you buy spot bitcoin and open a short on bitcoin futures at the same value. These two positions will cancel each other out (when the price of bitcoin rises, the value of the spot will cover the loss produced by the short and vice versa).

You are thus at net zero overall, but you collect those 15%+ that the longs pay out to shorts.

However, performing this operation can be challenging for some. Incidentally, this is what one of the most successful cryptocurrency projects of 2024, Ethena, built its business plan on. They actually do all this for the client, so he can just hold the stablecoin USDE, which also earns him a high return.

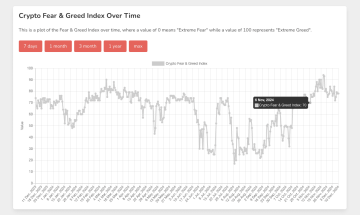

Fear and Greed index

The Fear and Greed Index, an index that shows how "greedy" investors are vs. how scared they are, has been going up sharply since the US presidential election. It has held steady at levels last seen around March 2024, when the euphoria of bitcoin ETF approval was in full swing.

The Fear and Greed index is relative, it does not reflect the price of bitcoin itself, but rather takes into account price movements. One strategy to work with this is that when the index is above 80%, it can mean the market is overheated. But the truth is that it is in an overheated market where the biggest gains can occur. And moreover, even an overheated market can last for an extended period of time. At the turn of 2022 and 2023, the Fear and Greed Index was above 85 for almost two months straight. From mid-November to mid-January.

The Fear and Greed index is very sensitive and volatile, but nicely shows the current market sentiment. Source: alternative.me

What will ATH be like this time?

Recently I came across an interesting chart that must have been relatively difficult to put together, but at the same time I can't 100% verify its accuracy. It's a chart of the estimated highest bitcoin price in the surveys, which is then pasted onto the BTC price trend.

The sample size is small, so the conclusions need to be taken with a grain of salt, but it basically shows that the steeper the price increase, the higher the top expectations. And when the price stagnates, even relatively high, expectations start to fall.

The old familiar rule "Price drives the sentiment" applies here too.

I have collected a lot of poll data for bitcoin cycle top expectations. Recent poll numbers haven't changed much from march 2024, suggesting that "retail is here" might not be so true after all.

— bitcoindata21 (@bitcoindata21) December 9, 2024

I have also said on numerous occasions that 100-150k is consensus... just look at the… https://t.co/B0gyiGc2vk pic.twitter.com/2e4JHCskQ5

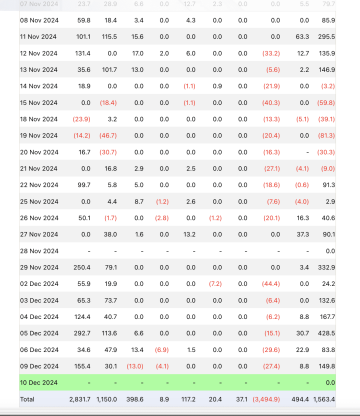

And how did Earnio do in November?

I'm not going to beat around the bush and write straight away that Earnio's result for November 2024 is a lovely 9.51%.

In addition, we continue to have open positions in considerable profit, which will likely be automatically closed over the next few weeks as the market develops.

This quality result is the outcome of our trading strategy, which I have historically defined for you in the Earnio results article for August 2024.

”If the market is at a crossroads, and it is going sideways and slightly down, we are willing to absorb even a small loss if we clearly catch the upside price action and bullrun.

...

We assume that the surge will cover those potential losses. It's the result of a risk vs. reward ratio. It may not work and the market will go down. That's what we're counting on.

...

We assume that the reward when markets go up will outweigh the risk when markets go down or continue to go sideways. And it will also outweigh the potential reward if we try to trade directly into that sideways move.”

That plan has now paid off handsomely. We have managed to trade off the price increase without having to take unnecessary risks of excessive leverage.

More or less all of our algorithmic startegies are in profit, for example the GGS strategy worked nicely, catching the incoming price surge early and starting to open trades early in the price movement.

"The GGS strategy is our most active (highest turnover) symmetric strategy that trades short and probable moves in the direction of the trend. It has a very flexible trade management, most of the position tries to take mainly probable profits, the rest are "runners" that adapt to the emerging market structure. The strategy itself consists of several variations of itself (depending on the time frame) to achieve better diversification."

One of the trades of the GGS strategy, which opened nicely at the beginning and gradually started to close. Source: ByBit

Earnio has also currently purchased a key venture capital investment (venture capital investment in a start-up project), which was made via an OTC (over-the-counter) purchase into a smaller token that is currently up +100% in price. However, liquidity is smaller there, so realization of profit here will be gradual.

By the way, if you think you've come across an interesting project, feel free to message me on social media, I'd be happy to see if it would be interesting for us to include in the portfolio. Of course the more you can write about the project the better.

Clients who have been with us for a really long time may remember that we covered similar investments in early-stage projects in a previous bullrun.