Earnio results for March 2025

2 weeks ago

Tomáš Hucík

March kept crypto investors on their toes, as the market struggled to find its footing after February’s steep drop. But most rode the same rollercoaster of early-month optimism fading into mid-month volatility.

In short, March was a mixed bag: a tentative stabilization for Bitcoin, continued pain for many alts, and an overall market searching for direction amid conflicting signals produced by none other than Donald Trump. In a market that moves based on how Donald Trump tweets, algorithmic strategies that relay on statistics and mathematics tend to struggle. How do you prepare for complete randomness?

This is one of the reasons why we finished this month with the result of -12.55%

This volatile and random market doesn’t really suit our Dynamic strategies, but it is the same problem for every fund manager, who needs to deal with a risk management. See discussion between Jakub Jedlinský and Jakub Vejmola aka. Kicom. While Jakub Jedlinsky used big hyperboly, that doesn’t really apply to us, but other than that described quite well that is is hard to react to this twitter randomness for a algorithmic fund. Because how do you teach an algorithm to calculate with something like this?

What you can do though is work on your risk parameters. Stop losses, position sizing, leverage and so on. This is also the reason why from April we have turned on also shorts on some of our strategies. These will hedge those “long” oriented. We might miss some upside, but the downside is covered better. However, the portfolio is still a little bit more long oriented. The market seems to calm down little bit at least for the time of writing this article (11.4.)

The most important part is to look at the bigger picture, longer timeframe. Investing and comparing results from month to month might skew the optics. If you do so, you might capitulate when the first few losses occur.

Would you invest in this asset?

Source: tradingview.com

And what about this one? Because it is the same asset. SP500, the most famous stock index in the world. That is the reason you need to have a bigger picture and longer timeframe in mind.

Source: tradingview.com

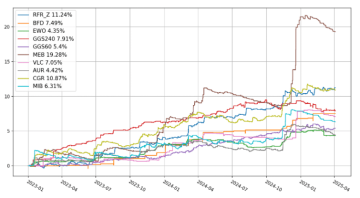

We can look at the strategies at our algorithmic strategies in Dynamic as well.

This is their historical performance without weights. The market structure of the last 2 months indeed did not suit us well, that is the reason why short trading will be implemented as well.

Source: results of individual Earnio strategies in %

Important take from this is not to panic and trust the process. Short term results can vary, but long term results matter. And as it is clearly visible on the chart, the overall trajectory is upwards.

Market overview

Bitcoin (BTC) traded in a choppy but largely range-bound fashion between roughly $80,000 and $88,000, ultimately ending the month down a few percent. The broader crypto market cap declined about 4.4% in March – a relatively modest pullback compared to February’s rout, but still a sign of persistent caution. Ethereum (ETH), however, significantly underperformed: it tumbled nearly 17% (from ~$2,221 to ~$1,843), marking the worst performance among top assets. Other altcoin bled as well. By month’s end, BTC dominance had climbed above 62% as investors favored the relative safety of the crypto heavyweight copamred to the altcoins.

Equities also wobbled (the S&P 500 fell ~7% from its peak), underscoring a “risk-off” mood.

All told, March 2025 can be characterized as a dangerous time filled with fear and uncertainty.

Tariffs and Regulation

As already mentioned, global trade tensions took center stage on the macro front in March, creating a challenging backdrop for all risk assets. U.S. President Donald Trump escalated tariff measures throughout the month, stoking fears of inflation and slower growth.

On March 4, the U.S. slapped a 25% tariff on imports from Canada and Mexico, set to expire in early April . A week later, Washington turned up the heat globally with a 25% blanket tariff on steel and aluminum imports from all countries (effective March 12) This move prompted loud objections and promises of retaliation from trading partners – the EU prepared counter-tariffs to kick in by April, for example.

Tariffs on Chinese goods were also raised to around 20% in aggregate, met by China imposing new duties on U.S. agricultural exports. The back-and-forth policy volleys introduced significant uncertainty. Such trade barriers tend to be seen as inflationary (by raising import costs), so these developments kept investors on edge that central banks might stay hawkish for longer. In the crypto market, each new tariff headline often translated into a flicker of volatility – a knee-jerk “risk-off” reaction as algorithms and traders braced for potential economic fallout. In fact, late in the month when Canada and Mexico threatened retaliation, crypto derivatives markets saw a spike in liquidations (over $1B wiped out in a single day) amid the turmoil . Tariffs clearly remained a key macro risk in March, casting a shadow over any bullish impulses.

Tariffs even overshadowed other positive news. Most dramatically, President Trump signed an executive order establishing a “Strategic Bitcoin Reserve” – the first of its kind in U.S. history. Under this plan, the government will hold onto seized Bitcoin rather than sell it, effectively treating BTC as a strategic asset in the national reserve. (Notably, the order didn’t authorize new purchases of Bitcoin beyond using already-confiscated coins, tempering some of the initial market euphoria .)

Meanwhile, lawmakers advanced clearer rules – the Senate Banking Committee green-lit the GENIUS Act, a bipartisan bill to establish a formal framework for stablecoins. And traditional finance regulators showed openness as well: the U.S. OCC (Office of the Comptroller of the Currency) issued guidance permitting banks to custody cryptocurrencies for clients .

In sum, March 2025 presented a tale of two realities: harsh trade politics creating a risk-off atmosphere, but simultaneously a regulatory climate gradually tilting in crypto’s favor. This tension between macro headwinds and policy tailwinds defined the month’s narrative.

BTC ETF Flows

After February’s record-setting ETF outflows, March saw a noticeable shift in institutional flows. The month began on a similar defensive footing – there was a single-day withdrawal of over 400 BTC from U.S. Bitcoin ETFs in the first days of March, followed by two more days with ~350 BTC outflows . These early withdrawals continued the trend of big money reducing exposure. However, by the second week of March, the tide started to turn. In fact, spot Bitcoin ETFs recorded eight straight days of inflows through late March, totaling roughly $896.6 million added . This included the largest single-day influx in over a month on March 17, as major asset managers like BlackRock’s iShares and Fidelity’s funds led new purchases.

Source: coinglass.com, BTC ETF flows by day

While the net flows for March were relatively muted compared to the wild swings of February, the return of inflows was a welcome sign. Analysts noted that only a subset of funds drove the gains – a few heavyweights saw sizable inflows while some smaller ETFs still bled assets. The renewed demand from ETFs likely helped put a floor under Bitcoin’s price by absorbing some sell pressure.

Exchange Flows

A crucial question in March was whether investors were accumulating the dip or continuing to sell. On-chain exchange data gives some clues. In the first half of the month, the picture was mixed – the overhang of February’s fear meant many traders kept coins on exchanges ready to sell into any rallies. Indeed, net inflows (coins moving onto exchanges) spiked early in March as prices briefly popped, suggesting some investors took that strength as an opportunity to unload.

However, as markets settled and Bitcoin hovered in the low-$80Ks, buy-the-dip appetite quietly emerged. By late March, at least some signs of accumulation were evident: March 25 saw over 27,700 BTC (worth ~$2.4B) withdrawn from exchanges in a single day – the largest daily BTC outflow since mid-2024. Such large outflows typically indicate investors moving coins into long-term storage (out of sell-ready positions), a bullish signal that big players were stepping in.

Likewise, stablecoin flows pointed to sidelined capital re-entering the crypto ecosystem – an estimated $6.8 billion of stablecoins flowed into exchanges or crypto wallets over the month, bolstering liquidity and perhaps foreshadowing new buying.

Just to make it clear, not everyone was in accumulation mode; plenty of retail investors and shorter-term traders were still cautious or selling into any upticks. Exchange balances of ETH, for instance, remained elevated after ETH’s price drop, reflecting some continued aversion to risk.

Community Buzz

Out in the crypto community, sentiment in March slowly shifted from despair toward cautious optimism. The month began with forums still reeling from February’s crash – “crypto winter” fears and bearish memes were widespread in early March. The Crypto Fear & Greed Index, which spent early March in “fear” territory, began creeping back up toward neutral by month’s end – an anecdotal sign of recovering confidence.

Source: alternate.me. We can see a small rebound in sentiment

The community also had plenty of news to chew on. A major talking point was the U.S. government’s newfound engagement with crypto. The White House Bitcoin Summit on March 7 generated buzz as industry leaders met directly with Washington officials – something almost unthinkable just a couple years ago. Many in the crypto space saw it as validation that crypto has “arrived” on the big stage, even if tangible policy changes from the summit remain to be seen.

President Trump’s executive actions (from tariffs to the Bitcoin reserve) drew mixed reactions: some applauded the strategic embrace of Bitcoin, while others in online forums quipped that crypto was becoming a geopolitical pawn. In altcoin communities, there were celebrations and silver linings too. XRP holders rejoiced as the SEC formally dropped its appeal in the long-running Ripple case, effectively ending a four-year legal battle and removing a cloud that had hung over XRP.

The outcome was hailed as a landmark win for crypto against regulatory overreach, and “#XRPArmy” posts were filled with triumphant gifs. Developers and DeFi enthusiasts, meanwhile, noted that on-chain activity slowed during the market pullback.

Looking Ahead

Several key things to watch in the coming weeks:

First, any updates on the tariff front – a further de-escalation could spark relief rallies, while escalation would likely renew crypto’s correlation with risk-off moves.

Second, the progression of stablecoin legislation and other crypto bills in Washington. Continued momentum there would be a bullish signal for the industry’s long-term viability.

Third, the behavior of big investors – will the late-March trend of ETF inflows and whale accumulation continue into April, indicating sustained institutional dip-buying?

Thus far, early Q2 signs are promising on that front, with spot Bitcoin ETFs extending their inflow streak . And finally, macro data like inflation and growth reports will be crucial: any downside surprises in inflation, or hints of central banks stepping in to support growth, could light a fire under crypto prices, while negative shocks would do the opposite. If macro conditions stabilize and no new shoes drop, many believe crypto is poised to rebound from here. Yet prudence is the name of the game – everyone is aware that in this environment, fortunes can shift quickly.